Budgeting, the process of projecting expenses and recording transactions, is what helps me decide what I can buy and when. While budgets used to require diligent recording of receipts and careful stashing of cash- consumers today have dozens of digital options to keep track of their finances. In search of the perfect tool, I spent nearly two months testing and reviewing five of the most popular budgeting apps to see which qualities make them distinct. Each platform had unique draws with specific needs in mind, but a few definitely pulled ahead. Check out the best of the best and find the system that works for you!

Mint

A member of the Intuit family, Mint is run by the same company that offers TurboTax and QuickBooks. It is one of several budgeting apps that allow you to link your bank accounts, credit cards, and loans for review. While setting up my account, I was impressed that Mint was able to connect to my local bank accounts in Kansas. My experience with other programs, like PocketGuard, did not allow this- making it difficult to get a full financial picture. Once I linked my accounts, it took a couple days to understand the layout of the site. Mint boasts the capacity to set investment goals, budget, and monitor your credit score- but it can be a little overwhelming at first glance. I’m still not sure that I’m making full use of Mint’s impressive capabilities.

Setting up the budget did take time. When I went to my transactions tab, I had to spend a significant amount of energy recategorizing month old expenses- for example, my Discover It Credit Card Payment was classified as a Doctor’s Bill. Mint’s website does address this concern, asserting that the software “learns” along the way so you don’t have to make the same fixes every month. Ultimately, Mint is a fantastic option for individuals desiring a one-stop shop to provide them detailed investment, budgeting, and credit information. If you’re a first-time budgeter, this program may be a little advanced with accessories that distract from your focus.

- Pros:

- Set up Alerts for Late Payments and Bank Fees

- Free Credit Scorecard Access

- Run monthly, weekly, and yearly reports of spending and saving

- Cons:

- Less Intuitive Features Distract from Financial Goals

- Tech Shortcuts Lost on Cash-Only Consumers

- Takes Several Months to Get the Hang Of

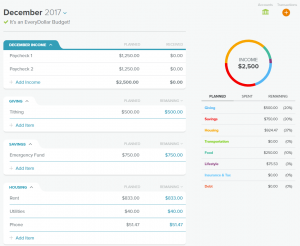

Every Dollar

Every Dollar is a newer website and app brought to market by Dave Ramsey’s company. Dave Ramsey is an outspoken personal finance guru and this program is designed to help consumers work through his Baby Steps initiative by focusing on debt repayment and goal setting. Full disclosure, this is the app that I walked into this experiment using as my primary. This app was the easiest to set up and I had a working budget in less than 10 minutes. The platform suggests major budgeting categories with smaller subcategories underneath- all completely customizable.

There is a free and paid version of the software and I chose to review the free. The free version cannot be linked to outside accounts, so it requires you to upload all expenses manually. It also has very limited reporting capabilities, making it most effective for short-term budgeting. Every Dollar is a great place to start budgeting, but an ineffective way to prepare for long-term expenses and is a time-intensive investment.

- Pros:

- Simple Set Up (less than 10 minutes)

- Manual Entry Reduces Miscategorization

- Links to Dave Ramsey Resources and Tips for more Learning

- Cons:

- Free Version does not Link to Bank Accounts

- Limited Reporting Features

- Narrow Financial Focus doesn’t Portray Full Financial Picture

You Need A Budget (YNAB)

This budgeting tool boasts a large cult following but does not offer a free version. A subscription today will run you $6.99/month. YNAB is unique because of its alternative financial method. YNAB is formulated around 4 main principles. Every dollar you earn has a “job” and it should only be used to accomplish that task. Embracing true expenses leads to better preparedness. Yearly expenses should be budgeted out over time (think saving $50/month for Christmas Shopping).

The most unique “rule” is to use money that is at least 30 days old to cover expenses. Using “older” money means that you use paychecks from last month to cover this month’s expenses, thus ending the paycheck to paycheck cycle. This is made possible through savings. YNAB offers many of the same reporting tools as Mint and educational tools as EveryDollar but does not offer a way to track investments. This option may be best for budgeters that have been unsuccessful using other methods and want a rigorous program to keep them accountable.

- Pro:

- Unique, Effective Approach

- Extensive Educational and Support Materials

- Focused Paycheck to Paycheck Cycle Reduction

- Con:

- No Free Version

- No Investment, Credit, or Bill Pay Support

- Less Intuitive for First Time Budgeters

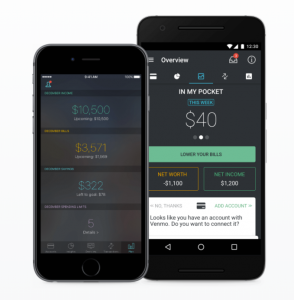

PocketGuard

PocketGuard is the only app I reviewed that used the countdown budget method. Upon sign in, I quickly found that Pocketguard was unable to link to either my local savings or checking account- making the import value mute for me. I was impressed that upon linking to my Discover card, PocketGuard quickly pulled out my recurring subscriptions and placed them into my budget.

Unfortunately, PocketGuard does not allow you to manually add cash transactions- so if you have bank accounts that can’t be linked you completely lose that part of the financial picture. The primary draw for PocketGuard is that it pulls out an “In My Pocket” value. This number takes your income, minus projected expenses and leaves you with a spending budget for the day, week, and month. For users that exclusively use big banks, this is a great alternative method focused on how much you CAN spend instead of how little you should spend.

- Pros:

- Focus on Usable Spending Allowance over Restrictions

- Simple Set Up and Format

- Can be linked to Services like Venmo and Paypal in addition to Banks and Credit Cards

- Cons:

- Limited Local Institution Linking

- Alienates Cash Users

- Occasionally Oversimplifies Financial Situation

GoodBudget

Previously named Easy Envelope Budget Aid, GoodBudget is a platform based on the envelope style of budgeting. The platform is a bit older looking than some of the other websites on this list, but the support is solid. Upon set up, users are prompted to set up annual and monthly envelopes with specific monetary caps. Annual envelopes are then broken down on a per month basis to assist with planning. This app does allow users to import bank records from QFX and OFX files, but it cannot be linked to bank accounts directly. I found the import ability to be a bit clunky due to the specific format requirements and chose to record all transactions manually.

The phone app proved to be somewhat disappointing due to the difficulty making adjustments to envelopes and budget period- something that was easily possible through the webpage. Ultimately, what sets this app apart from its fellow free platforms is the ability to run reports based on the payee, envelope, or month. It’s a great tool for beginner budgeters looking for the capacity to review behavior over a longer period.

- Pros:

- Run a Wide Array of Reports

- Simple Set Up

- Familiar Method to Offline Envelope Budgeters

- Cons:

- Manual Transaction Entry (or Limited Import)

- Less Visual Appeal

- Limited App Functionality

Wally

Wally is an app-only platform with an easy to use interface. The design is intuitive and users can import transactions by scanning physical receipts- a unique feature among the apps and websites I reviewed. Another notable feature is the ability to use any global currency- this one’s for you international readers! Additionally, Wally utilizes AI, GPS data, and algorithms to learn from your habits. The app can detect your location to shortcut the data entry process- assuming it’s a Grocery purchase if you’re at a Walmart or a Clothing purchase at H&M.

The reporting features of the app are fairly limited and through different updates, some users complain they’ve lost historical data older than 3, 6, or 12 months. Wally does allow you to export all your data into a CSV file for safekeeping- allowing users with a strong desire to run unique reports to do so. This is a valid option for users who don’t want to be tied to a desktop and appreciate access to a quick and simple budget on the go.

- Pros:

- Upload Receipt Photos with InstaScan

- Software Draws from Habits and Location to Simplify Data Entry

- Accessibility for International Users

- Cons:

- App Only

- Limited Reporting Capabilities

- Potential Loss of Data with Updates and Development of Paid Version

Budgeting Apps: The Verdict

There is an app and system for everyone. At the end of the experiment, I chose to keep a hybrid Mint and Every Dollar system. I record the majority of my purchases in Every Dollar because keeping track of them manually holds me accountable and forces me to face each and every purchase. Mint has proven to be a great jumping off point for financial information and tips that are, at least to some degree, customized to my needs. It also offers a fuller picture of each of my accounts and how they’ve fluctuated over time. I wouldn’t say that any one of these apps is perfect, but they each offer a lot of support and can help users accomplish a wide array of financial goals.

Think someone else could use this information? Be sure to share it across your social media accounts!

About the Author

Anna Zimmerman is a Communications Specialist at Gramercy Property Trust in New York City. While growing up and attending college in Kansas, she developed a passion for financial literacy within the young adult and female populations. She has served as a board member and guest speaker for a number of nonprofit and professional organizations around the country. She has diligently researched her own financial questions and loves sharing that information with family and friends.

Editor’s Note: This post is part 2 in a 2-part series on budgeting. You can view part 1 here: https://care4yourfuture.org/blog/budgeting-methods-101/