CARE would like to congratulate Hon. Martin Barash of the United States Bankruptcy Court, Central District of California, on being named CARE’s 2022 Volunteer of the Year! In 2022, Judge Barash selflessly donated his time and expertise to his local CARE chapter and helped make financial literacy education accessible for many.

“Throughout all the years I’ve known Judge Marty Barash, he’s been incredibly giving. He’s done everything from hosting mock trials for school kids in his courtroom, to chairing our education committee and inspiring our law clerks and externs, to spearheading the CARE program, including through the pandemic. Marty is truly a gift to all of us: he makes this world a better place. Thank you, Marty, and congratulations on this well-deserved award.” – Hon. Neil Bason

Q & A with Judge Barash

Why did you decide to get involved with CARE?

I became a federal bankruptcy judge to help people. Shortly after I started serving, however, the limitations of my role became clear. Although I was entrusted with the responsibility to adjudicate bankruptcy disputes and supervise bankruptcy cases, I had no ability to help people avoid the kind of problems that bring them to bankruptcy court. By participating in CARE, and speaking with young people when our message can have an impact on their developing financial habits, I feel like I am doing something to help prepare them for adulthood and avoid the pitfalls of uninformed credit use.

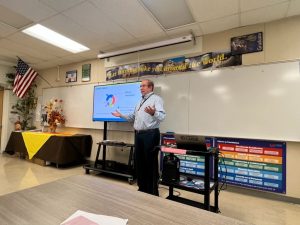

What is your most memorable moment or favorite story of being a volunteer?

No one moment stands out. But I feel a sense of immense satisfaction at the end of a program when I go around the room and have each participant tell me something they have learned from the presentation that they did not previously know. The next generation are smart and eager to learn from the mistakes of prior generations. But they need us to direct their attention to this issue and share our collective knowledge and experience.

Why do you think that financial literacy education is important?

For the simple reason that learning good financial habits is one of the keys to a happy and fulfilling life—and we don’t do enough in our schools to teach these fundamentals. Too many people in our country live under the strain of financial distress. This strain is, for many, the source of significant emotional and physical stress. For many people, this distress is the result of forces outside their control. But developing good financial habits is one thing that they can do to help navigate those pressures.

If there was one piece of advice you could give to young adults seeking financial independence, what would it be?

It may sound cliché, but don’t buy stuff you can’t afford. Whatever temporary pleasure or satisfaction you may derive from the things you buy it is not worth the long-term stress of being deeply in debt.

What message would you give to a CARE volunteer just starting out?

Don’t let the perfect be the enemy of the good. Don’t worry about whether your presentation is “perfect.” Just press forward. Treat it as a conversation with your audience.

What’s one takeaway you want students to learn from your CARE presentations?

That the “Minimum Payment” on a credit card bill is a trap! Pay your bill in full whenever possible. But always, always pay more than the minimum payment amount.