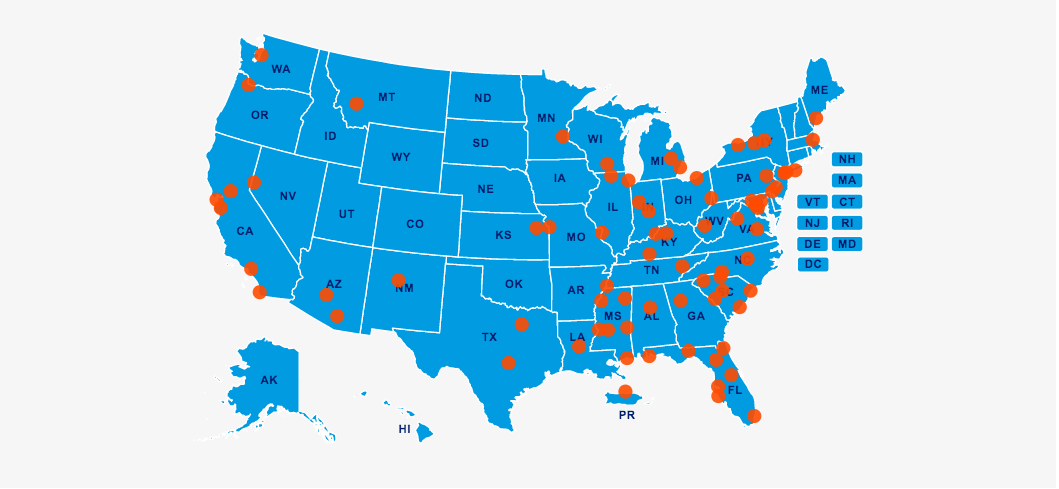

Photo Above: The map above shows the current locations of all active CARE chapters, where volunteers make an impact in their local communities.

When I joined CARE as Executive Director at the beginning of May, my first question was “How can we see that CARE makes an impact?” The question is an important one in any nonprofit organization and CARE is no different. This importance only increases once you look at the need that financial education organizations are attempting to meet.

We have a crisis of financial literacy across the country. Only 17 states require that high school students take a course in financial literacy. Further, fewer than 20% of teachers nationwide report feeling competent to teach personal finance topics. It is clear that we miss the mark on preparing our kids with the skills they need to make smart financial choices that help them through life. This has resulted in a shocking, but not surprising, consequence: an estimated four in ten Millennials say they are overwhelmed in debt.

Financial literacy education works. Studies show that kids are more likely to save, more likely to pay off their credit cards each month and are less likely to be compulsive buyers when they learn how to manage their money. That’s the driving force behind CARE.

How CARE Makes An Impact

From New York to Virginia to Kentucky to Illinois to Arizona and California, CARE chapters are reaching out in their communities and making connections that transform lives. Thousands of CARE volunteers give their time and share their expertise to support our nation’s schools and help educate our youth so they can make smart financial decisions. Moreover, CARE makes an impact through the voices and perspectives of local community leaders sharing real-world examples about personal finances.

I recently joined Mr. John Yoho’s class at Brunswick High School in Brunswick, Maryland with volunteers from CARE’s Maryland’s Chapter. We arrived for an early 7:30 am class and CARE volunteers Jeanne Crouse and Terri Lowery were ready to share our presentation on The Road to Financial Independence. This course is the third and final one in a series that covers everything from budgeting to the truth about credit. Over the past three weeks, students discussed the difference between a need and a want, how to responsibly use credit cards and how to pay for college.

CARE volunteers Terri and Jeanne used the basics of managing money to share personal experiences managing their own money as well as lessons learned from their work in the bankruptcy field. Terri shared with the class how easy it is to get off track. She mentioned that she works with an individual who makes $36,000 a year but has over $80,000 in credit card debt. And this individual is not alone. Terri and Jeanne told the class that every day they meet people in crisis because they did not have a plan or roadmap to help them guide the way.

With these real-life examples, CARE volunteers bring the lessons to life to help reach kids like those in Mr. Yoho’s class. In the months ahead, I look forward to sharing more about how CARE makes an impact and how you can get involved.

About Tammy

Tammy Hettinger is the Executive Director for CARE and has a long career of nonprofit leadership and fundraising. She lives in Alexandria, VA with her husband, two young kids, and the family cat.